Types of Life Policies

Instructor: Jason L. Perez

Department Authorized Insurance Education Provider

Types of Policies and Features 14%

A. Term Life Insurance

B. Whole Life Insurance

C. Universal Live Insurance

D. Annuities

E. Combination Plans and Variations

A. Term Life Insurance:

TERM = Temporary

- Temporary coverage can be for a little as one year (OR) stretch out to cover 20 to 30 years.

Basic Forms of Temporary Life Insurance.

Level – Decreasing – Increasing

[(5.2.1.1) p. 85]

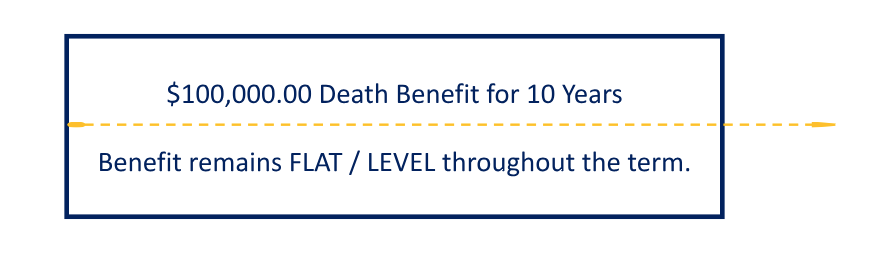

Level | Term Life Insurance

Level = FLAT 🡪 Stated pre-determined death benefit which does NOT increase or Decrease throughout the duration of the policy.

[Note] Insurance contracts are CONDITIONAL because, the payment of benefits is dependent on a specifically stated occurrence. With Temporary life insurance the condition is death within the specified timeframe.

[N.A.I.F.A]

LEVEL Term Life Insurance provides a level (consistent) amount of protection for a specified period.

[Example] $100,000.00 10-Year Term Life policy simply provides the policyowner with $100,000 in death benefits 🡪 ONLY IF the policyowner dies during the identified 10-Year timeframe

Conditional – Death occurring within the identified timeframe is the condition which triggers benefits.

- If the policyowner lives beyond the stated timeframe, NO BENEFITS ARE PAYABLE!

10 – Year Term

Coverage ENDS after 10-Years if the policyowner

DOES NOT Die (OR) RENEW for an additional 10-Years.

[(5.2.1.2) p. 85]

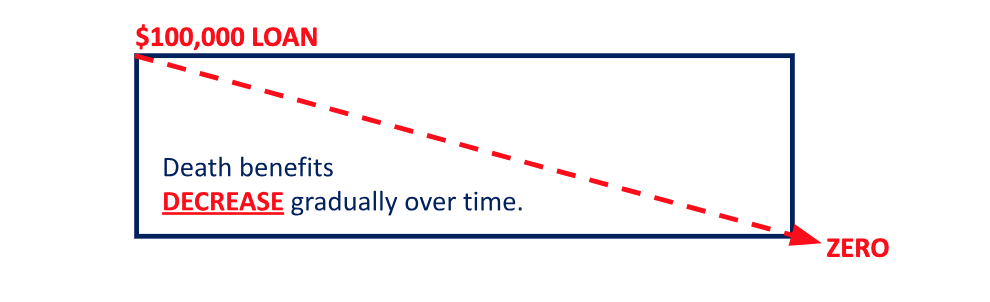

DECREASING | Term Life Insurance

DECREASE = Reduce.

[N.A.I.F.A]

Decreasing Term Life Insurance decrease gradually over the term of protection. Decreasing Term is used when the need for protection declines from year to year.

Riddle me this… WHY would someone want a life insurance policy that DECREASES to ZERO over time?

To collateralize a loan.

[Identify] Decreasing Term Life Policies are used to protect lenders against losses which may occur if the borrower dies before the loan is repaid.

The death benefit DECREASES periodically, in sync with the loan balance.

[(5.2.1.3) p. 86]

INCREASING | Term Life Insurance

[N.A.I.F.A]

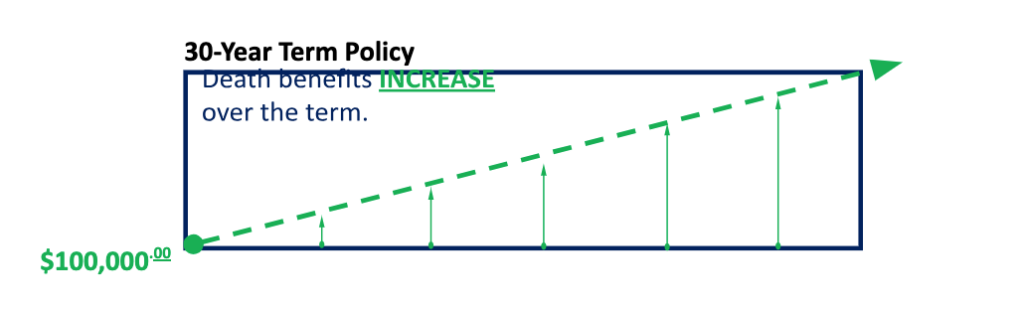

INCREASING Term Life Insurance provides a death benefit that INCREASES at periodic intervals over the policy’s term.

–WHAT is the main reason consumers should consider policies designed to gradually INCREASE over time?

INCREASING Term Life Policies utilize a “Consumer Price Index” (CPI) to establish how much more death benefit are needed for the policy to remain in sync with Inflation.

Increasing term policies come in FOUR different policy structures.

The standard Increasing Term POLICIES have a Cost-of-Living increase component built into the policy.

The second Increasing Term Life structure adds a Cost-of-Living RIDER to a Level Term Policy for an additional fee.

RIDERS are policy enhancements.

RIDERS COST EXTRA!

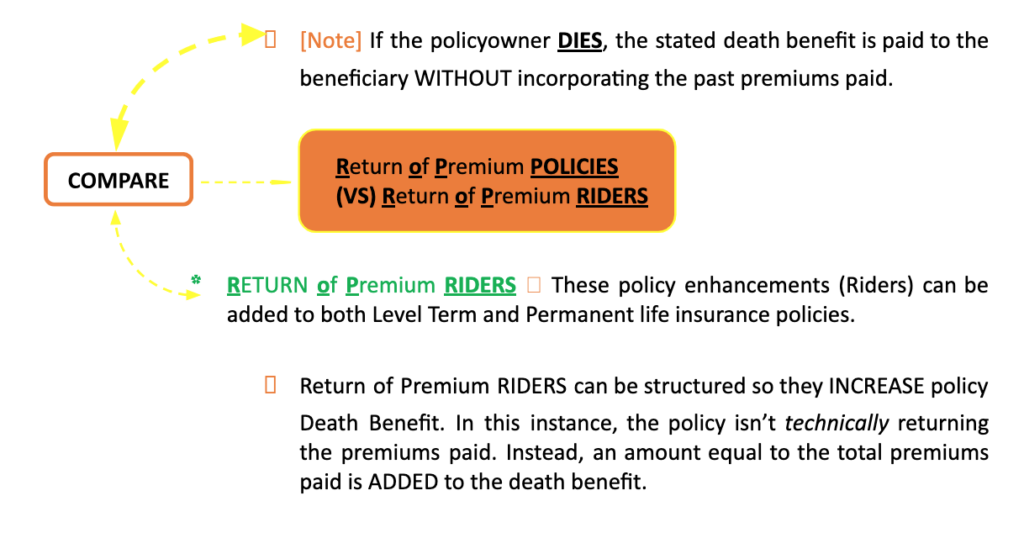

RETURN of Premium

The RETURN of PREMIUM Rider feature is SPECIFICALLY identified by the Florida Department of Financial Services as a TESTED Pre-Licensing topic.

RETURN of Premium POLICIES insurance is designed to RETURN 100% of ALL premiums paid to the insurer, back to the policyowner IF THEY LIVE beyond the policy’s stated term.

[(5.2.3) p. 88]

Term Life Premiums 🡪 Since the probability of death increases with age, Term life insurance premiums also increase with age.

When the policy is RENEWED… premiums are adjusted upwards to address the policyowners advanced age.

This premium increase is

referred to as the STEP RATE.

Term Life [(5.2.2.1) p. 86]

Option to Renew

*Term Life Insurance is issued as *GUARANTEED Renewable.

GUARANTEED Renewable policies allow the policyowner to RENEW – before its termination date, WITHOUT 🡪 Evidence of Insurability.

Premiums for the renewal period will be higher that the initial period.

[Identify] Annually Renewable Term

🡪 NOT considered an “Extended Term Policy”.

Provides coverage for ONE YEAR and allows the policyowner to renew coverage each year, WITHOUT Evidence of Insurability.

Annually Renewable / Yearly Renewable Term Life

MOST BASIC type of Term Life policy

RE-Entry Option

(VS) Renewability

Re-Entry Term Policies – the policyowner is GUARANTEED, at the END of the Term, to be able to RE-NEW coverage WITHOUT Evidence of Insurability.

MOST insurance policies are issued as Guaranteed Renewable. This means, when it’s time for the policy to be renewed / Re-entered, insurers waive all underwriting requirement and automatically approve all request at STANDARD Risk Rates. Even if the policyowner initially qualified as a Preferred Risk.

If a policyowner submits Evidence of Insurability in an attempt to qualify for a Premium Discount and found to be UNINSURABLE…

The policy is Renewed / Re-entered

at the STANDARD RISK RATE.

[(5.2.2.2) p. 87]

Option to CONVERT

What are we CONVERTING our TEMPORARY Life Policy INTO?

PERMANEMENT Life Insurance.

The Option to CONVERT gives the insured the right to convert (OR) Exchange the Term policy for a PERMANENT Plan WITHOUT Evidence of Insurability.

How are converted premiums calculated?

Attained Age

(VS) Original Age

Attained Age = Date the policyowner CONVERTED / Attained their term life policy into a new permanent life policy.

Original Age = Date the policyowner purchased their ORIGINAL Policy.

[Identify] Premiums calculated using the policyowners age when they ORIGINALLY purchased the policy will naturally be LOWER.

The Option to Convert a Temporary Policy into Permanent Life Insurance TYPICALLY ends when the policyowner reaches a specified age like 55 (OR) 60.

The conversion age is determined by the insurer so, it’s NOT Tested.

Traditional Whole Life Products

NAIFA CODES

1. Ordinary Whole Life [k,(5.1.1) ]

2. Limited – Pay and Single Premium Life [k,(5.3.3.2, 5.3.3.3) ]

B. Interest / Market – Sensitive / Adjustable Life Products

Basic stuff like “HMU” – You know… *Hit Me Up! For those who need a little insight into what “Hit Me Up” means, I got you. HMU / Hit me up means “call or text me” – SMH. All these new conversational shortcuts require a little effort to get under control.

Most of you are like – “Jason, I already know this stuff.”

Duh – My point exactly! The rest of this course is just as easy to remember. We avoid textbooks and glossaries like COVID. Instead, we’ll talk about current events and identify laws by poking fun of the people who were recently arrested committing insurance crimes in Florida. The audacity of these geniuses will leave you shaking your head.

We separated this 4-Hour Law & Ethics Continuing Education class into 15 Episodes (Chapters). My “informal tone”, it’s not just for the introduction. We’re going to talk like BFF’s, while discussing the DFS and keep it simple throughout the entire course.

Now, huddle around this CE campfire.

We’re about to dive into this course after these messages from iFlash4u (.com).

Interest / Market – Sensitive / Adjustable Life Products

NAIFA CODE:

1. Universal Life [k,(5.6.3) ]

2. Variable Whole Life [k,(5.6.3) ]3. Variable Universal Life [k,(5.6.4.2) ]4. Interest – Sensitive Whole Life [k,(5.6.1) ]5. Indexed Life [k,(5.6.3.2) ]

The Keywords and concepts highlighted in our flashcards also appear in the green boxes throughout the course. THESE ARE the tested topics.

« | Continuing Education & Compliance Period

® One CE Compliance Period is Two Years

® Newly Licensed Insurance Agents MUST complete #24–hours of Continuing Education every two (2) years.

® Newly Licensed = Less than 6–Years

C. Term Life

Basic stuff like “HMU” – You know… *Hit Me Up! For those who need a little insight into what “Hit Me Up” means, I got you. HMU / Hit me up means “call or text me” – SMH. All these new conversational shortcuts require a little effort to get under control.

Most of you are like – “Jason, I already know this stuff.”

Duh – My point exactly! The rest of this course is just as easy to remember. We avoid textbooks and glossaries like COVID. Instead, we’ll talk about current events and identify laws by poking fun of the people who were recently arrested committing insurance crimes in Florida. The audacity of these geniuses will leave you shaking your head.

We separated this 4-Hour Law & Ethics Continuing Education class into 15 Episodes (Chapters). My “informal tone”, it’s not just for the introduction. We’re going to talk like BFF’s, while discussing the DFS and keep it simple throughout the entire course.

Now, huddle around this CE campfire.

We’re about to dive into this course after these messages from iFlash4u (.com).

Term Life

NAIFA CODES

1. Types [k,(5.2.1) ]

a. Levels [k,(5.2.1.1) ] b. Decreasing [k,(5.2.1.2) ] c. Return of Premium [k,6.6.8) ] d. Annually Renewable [k,(5.6.1) ]2. Special Features [k,(5.2.2) ] a. Renewable [k,(5.2.2.1) ] b. Convertible [k,(5.2.2.2) ]

#IF you’ve been licensed in good standing for six (6) consecutive years (3 Compliance Periods), the Department of Financial Services will give you a 4–Hour CE Discount. In theory, the 6-year benchmark means you learned something along the way.

Starting on our 4th Compliance Period, insurance agents are ONLY responsible for 20–hours of CE. Maybe it’s the CFO’s way of congratulating us for making it 8-Years as an agent.

– Meniachiacial laugh!

Have you noticed all the BOLDED & underlined words?

What about all my dramatic colors?

All these exaggerations are highlighting the test gems we’ve dropped for you to find. These aren’t just any type of nugget. We are talking about *DEFINITELY tested topics. If the words are all dressed up like they’re off to the prom, it’s important.

| GREEN = Insurance Flashcards 4u

D. Annuities

Basic stuff like “HMU” – You know… *Hit Me Up! For those who need a little insight into what “Hit Me Up” means, I got you. HMU / Hit me up means “call or text me” – SMH. All these new conversational shortcuts require a little effort to get under control.

Most of you are like – “Jason, I already know this stuff.”

Duh – My point exactly! The rest of this course is just as easy to remember. We avoid textbooks and glossaries like COVID. Instead, we’ll talk about current events and identify laws by poking fun of the people who were recently arrested committing insurance crimes in Florida. The audacity of these geniuses will leave you shaking your head.

We separated this 4-Hour Law & Ethics Continuing Education class into 15 Episodes (Chapters). My “informal tone”, it’s not just for the introduction. We’re going to talk like BFF’s, while discussing the DFS and keep it simple throughout the entire course.

Now, huddle around this CE campfire.

We’re about to dive into this course after these messages from iFlash4u (.com).

Annuities

NAIFA CODES:

1. Single and Flexible Premium [k,(11.3.1.1, 11.3.1.2) ]2. Immediate & Deferred [k,(11.3.2.1, 11.3.2.2) ]3. Fixed & Variable [k,(11.3.4.1, 11.3.4.2) ]4. Indexed [k,(11.3.4.3) ]

E. Combination Plans & Variations

Basic stuff like “HMU” – You know… *Hit Me Up! For those who need a little insight into what “Hit Me Up” means, I got you. HMU / Hit me up means “call or text me” – SMH. All these new conversational shortcuts require a little effort to get under control.

Most of you are like – “Jason, I already know this stuff.”

Duh – My point exactly! The rest of this course is just as easy to remember. We avoid textbooks and glossaries like COVID. Instead, we’ll talk about current events and identify laws by poking fun of the people who were recently arrested committing insurance crimes in Florida. The audacity of these geniuses will leave you shaking your head.

We separated this 4-Hour Law & Ethics Continuing Education class into 15 Episodes (Chapters). My “informal tone”, it’s not just for the introduction. We’re going to talk like BFF’s, while discussing the DFS and keep it simple throughout the entire course.

Now, huddle around this CE campfire.

We’re about to dive into this course after these messages from iFlash4u (.com).

Combination Plans & Variations

NAIFA CODES:

1. Joint Life [k,(5.5.3) ]

2. Survivorship Life (Second to Die) [k,(5.5.3) ]

By: Jason L. Perez

Department Authorized Insurance Education Provider

⭐️⭐️⭐️⭐️⭐️ | The Insurance School .com