Types of Health Policies

Instructor: Jason L. Perez

Department Authorized Insurance Education Provider

Types of Health Policies 16%

A. Disability Income:

B. Accidental Death & Dismemberment

C. Medical Expense Insurance

D. Medicare Supplement Policies

E. Group Insurance

F. Individual/Group Long Term Care (LTC)

G. Other Policies

Moral Hazards

(VS) Moral + (E) = Morale

A. Disability Income :

[k, (18.1) p. 310] Purpose of Disability Income

Purpose of Disability Income Insurance

Disability Income Insurance either covers only Accidents (OR) Accidents & Illnesses.

– Insurers DO NOT sell illnesses-only policies.

Disability Income protects against the ECONOMIC DEATH of a wage earner.

Economic Death…

it’s as dramatic as it sounds.

Let’s get lost in the concept of death for a moment. When a wage earner dies, they’re no longer contributing to the household bills. #Onflipside à Being dead means they’re not consuming household resources. Totally Disabled people require expensive around the clock care.

Economic Death

It’s cheaper to die.

To say a total disability is a lifestyle adjustment is an understatement. Providing around the clock care is expensing and time consuming. Disabilities are the most intrusive life event someone could experience. When you imagine the lifetime cost of a of care, it’s easy to see, DEATH is significantly cheaper than living. Disability income insurance helps individuals / households avoid a complete Financial Collapse.

1. Occupational Coverage

à Occupation = Job

ü Policyowner DOES NOT have a hazardous occupation.

ü Occupational Coverage provides 24/7 around the clock protection regardless of if the policyowner is at work (OR) engaged in personal activities.

2. Non–Occupational Policies

à NON–Occupation = DOES NOT cover work related injuries.

ü Insinuates the policyowner has a hazardous / High-Risk job like, a Fireman (OR) Police Officer.

ü Non-Occupational policies ONLY cover disabilities/injuries which occur while the insurer is NOT at work à Non–Job–Related injuries.

Disability INCOME is paid monthly à Not in a Lump-Sum

Policies are issued as Guaranteed Renewable.

[k, (18.2) p. 310]

Disability INCOME Benefits are LIMITED!

Ü INCOME benefit will NEVER Exceed the insureds income.

WHAT is the purpose of limiting Disability Income benefits?

Malingering

Procrastinating

- Getting paid to do nothing sounds like one of my three wishes. If a disabled EMPLOYEE received 100% of their pre-disability income when recovering from a Total Disability, they’d “recover” for as long as possible.

Group Disability Income policies incentivize employees to return to work by only paying them a PERCENTAGE of their pre-disability INCOME (Earnings).

PERCENTAGE = Less than 100%

In theory, reducing income during periods of Total Disabilities incentivizes the employee to return to work sooner. The thought process here is, NOBODY wants to learn how to live off less money. Reducing disability earning by 20% – 30% means employees are more likely to return to work instead of dragging out their recovery.

- Group Disability Income Benefits

*Pay a Percentage of Earnings to help reduce the likelihood of MALINGERING.

[Note] DID YOU KNOW…

MOST people have insurance coverage provided by an employer.

Ü If Disability Income policies INDEMNIFIED employees, the employee would à MALINGER = Procrastinate à Stay on disability longer than medically necessary.

Disability INCOME benefits are ALWAYS

tied to the insured’s EARNINGS.

[Note] Life Insurance

Applicants can buy as much as they can afford.

? QUESTION…

HOW are Disability INCOME Benefits determined?

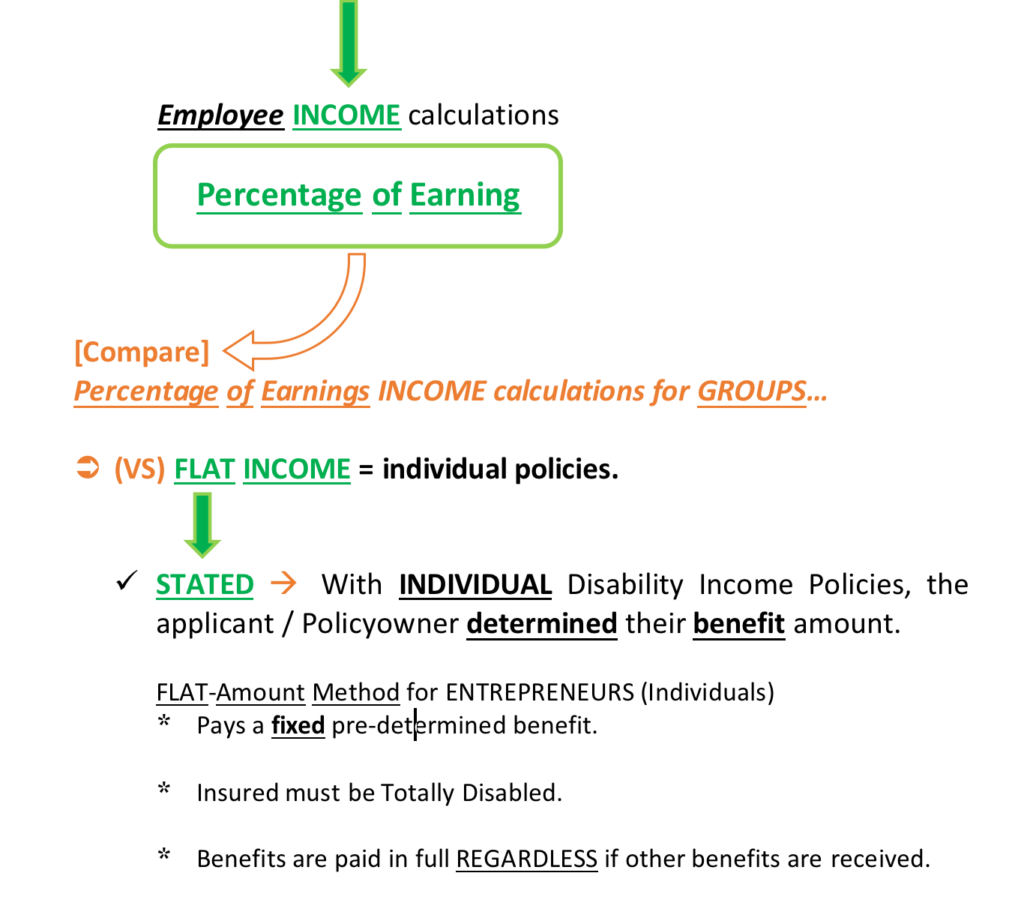

Percent of Earnings Formula

= GROUP Disability Income

Ü EMPLOYERS only cover a portion / PERCENTAGE of the employee’s pre-disability income. Once the MAXIMUM Percentage of earnings is determined, all other income benefits received by the employee are counted toward the EMPLOYERS stated maximum benefit amount.

- [Example] Jason earns $2,000 per month.

His group disability income policy will pay 80% of Jason’s income during the first 2-Years of TOTAL Disability. This means his employer will pay a MAXIMUM of $1,600 per month in disability income. WHAT IF Jason had a small disability policy he paid for?

Imagine his other policy paid him $1,000 a month for total disabilities. Under a PERCENTAGE of Earnings calculation, how much would Jason’s Employer policy pay him?

ONLY $600.00

ü $1,600.00 = MAXIMUM Disability Income

ü – $1,000.00 = Jason’s other income benefits

Employers’ obligation

ONLY $600.00

Totally not fair however… the PERCENTAGE of Earnings income calculation strategy is used by EMPLOYERS. This percentage represents the MAXIMUM amount of disability income their employees are eligible to receive from ALL SOURCES.

FACT:

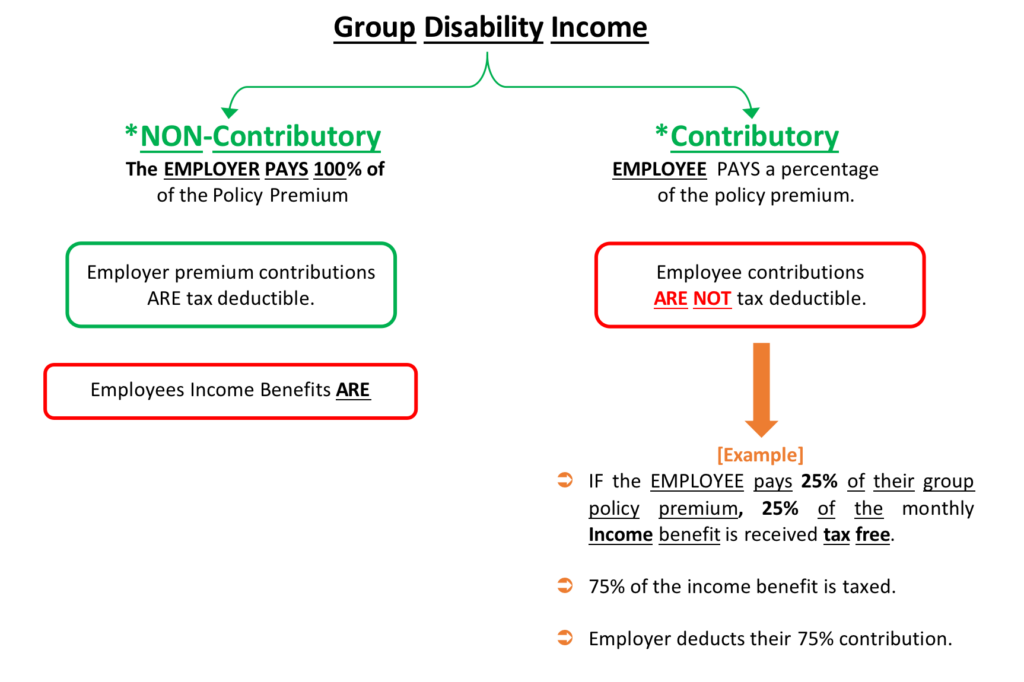

INCOME is Taxed.

? [Q] QUESTION | Riddle me this…

- WHEN is 100% of the income provided by a Disability Income policy taxable?

- [A] ANSWER– When the EMPLOYER pays for 100% of the employees’ insurance benefits. These à [Note] If Jason’s personal policy paid him a FLAT $1,500.00 in disability income per month, his employers income benefits CAN NOT be reduced below $500.

- employee arrangements are called Non–Contributory because…

[Define] Non–Contributory

- Employees DO NOT PAY any portion of their Group policy PREMIUMS.

NON–Contributory

= Income benefits are TAXED.

INCOME

TAXES | HOW are Disability Income Insurance benefits taxed?

WHY do Individual Disability Income Policies pay benefits TAX-FREE?

é Individual Disability Income Policies ß NOT GROUP

100% of the policy premium is paid by the insured.

Income benefit is received TAX FREE.

Policy premiums are NOT tax deductible.

Income is typically specified as a FLAT amount.

WHY do employees pay taxes on the disability income payments they receive?

éGroup Disability Income Policies

Taxation depends on WHO Pays the premium & how much of it they pay.

Group Disability Income Insurance premiums

ARE a tax deduction for the employer.

PERCENT of Earnings Method.

ü Employees don’t pay taxes on the premium payments employers make.

ü Employees are responsible for paying taxes on the income they receive for the policy.

Industry / American standard

Income is paid monthly.

⭐️⭐️⭐️⭐️⭐️ PRESUMPTIVE Disabilities.

é The disability is so severe, the person is AUTOMATICALLY PRESUMED to be TOTALLY Disabled

? QUESTION

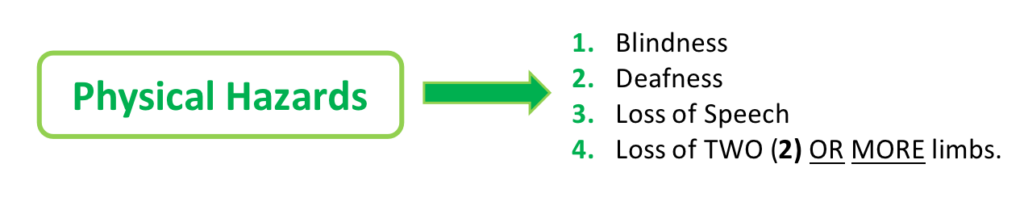

WHAT disabilities automatically presume the insured is TOTAL DISABLED?

[NOTE] [K, (1.4.2) p. 9]

- Perils & Hazards

- HAZARD = Factor that gives rise to the Peril

- PERIL = The event which causes the loss.

- IF a building is burning… FIRE is the peril.

When injured in an accident… The accident is the peril.

[Identify]

DISABILITY CLASSIFICATIONS

- PRESUMPTIVE Disabilities

- Blindness – Deafness – Loss of Speech – Loss of Two (OR) MORE Limbs

AUTOMATICALLY TOTALLY Disabled.

- TOTAL Disabilities àDefinition determined by the insurer.

[Define] Own Occupation

- [Identify] 24-Months = Short-Term Disabilities

- PARTIAL Disabilities = *ANY Occupation

Phase TWO of the Percent of Earnings method à AFTER 24–Months

- PARTIAL Disabilities only acknowledged AFTER the individual has FIRST been Totally Disabled.

VIOLATION | CFO Press Release

WHOOP, WHOOP…

That’s the Sound of the Police!

KAREN got caught coming in HOT!

Department of Financial Services

(VS) Karen S. Baker

FELONY DUI | NOTICE OF REVOCATION

CASE NO.: 285978 -21 -AG

N https://www.doah.state.fl.us/FLAID/DFS/2021/DFS_285978-21-AG_10062021_012622.pdf

Ü Sarasota County, Florida’s Twelfth Judicial Circuit Court

Case No. 2020CF007422NC

KAREN should have known better than to drive under the influence. She was adjudicated guilty after pleading “nolo contender” to one FELONY count of Driving Under the Influence. The “felony” component insinuates KAREN has done this before.

We highlighted this violation because, it’s fun to slide a ligitimimate pop culture Karen stereotype into the mix. On flip side, we tend to overlook non-insurance related incidents like DRUNK DRIVING.

ü Arrested for a crime,

30 Days to inform the DFS.

– Perils & Hazards [K. (1.4.2) p. 9]

Typically, when I think of punishable insurance violations, my brain gravitates toward average insurance crimes like, misappropriation of funds, fraud or identity theft. The problem is, those are blatantly obvious offences. Of course you’re going to lose your license.

ü FELONY DUI = NOTICE OF REVOCATION

*Felony Convictions are grounds for the immediate revocation of a license.

KAREN is a Morale Hazard!

POP QUIZ

- When KAREN drove drunk, she was a danger to…

- Herself

- Other Drivers

- Pedestrians

- Property

- ALL OF THE ABOVE!

[Compare]

Moral Hazards

(VS) Moral + (E) = Morale

- Moral Hazards are personal tendencies or habits which will only cause you harm.

An alcoholic who drinks excessively in the privacy of their own home. They DO NOT affect others around them.

- MORALE… The “E” in Morale is for EVERYONE.

– [Identify] Karen drink excessively. When she’s drunk at home, she’s a Moral Hazard to herself. The moment she jumps behind the wheel of a car, she’s jeopardizing EVERYONE around her.

– Drunk Driving makes Karen a MORALE Hazard with an indifference to the safety of the people around her. It’s IMPOSSIBLE for a person who doesn’t care about the others around them to be TRUSTWORTHY.

Ü When a licensee is convicted of a felony, their license & appointments are immediately revoked by the Department.

– [626.631(1)]

Ü The licensee may request a hearing pertaining the revocation. The point of the hearing is to determine if the revocation should be rescinded because the licensee wasn’t actually convicted of a felony.

OBVIOUSLY… Karen isn’t going to be requesting a hearing because she’s Guilty AF! Her felony conviction constitutes grounds for the immediate revocation of her licenses and appointments. The moral(e) of my story…

The MORALE of the Story…

Don’t be a KAREN.

«Licensees like Karen have 30–DAYSto notify the DFS of an arrest.

Disability Income

Industry Standards

* Insured to be under the care of a physician.

* Income losses must total more than a 20% à 25%.

Elements of an Insurable Risk

Amount to be insured must be large.

WHAT caused the disability?

éHOW are disabilities defined?

[k, (18.2.4) p. 313]

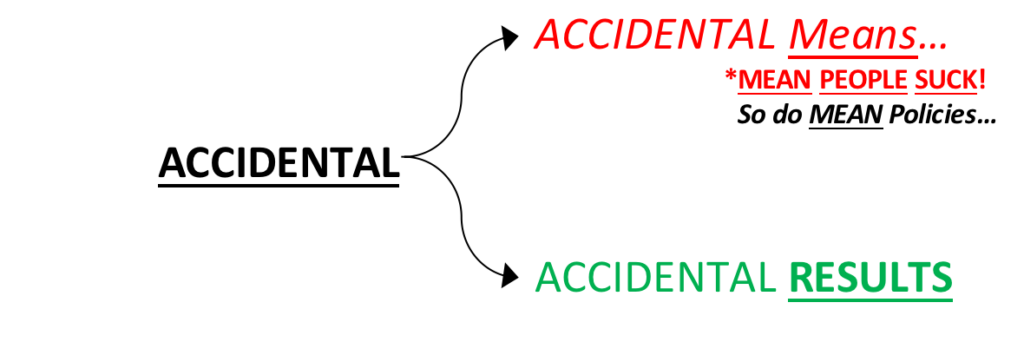

Accidental Means Provision

* Provisions provide…

Provisions identify policyowners rights terms and conditions associated with the policy.

EXAMPLE [k, (22.1.3.2) p. 358]

– Think of the HEALTHCARE Grace Period Provision…

This Provision DEFINES the consumers rights as they pertain to paying policy premiums. In Florida, healthcare policies automatically come with a 10-Day grace period if premiums are paid monthly. IF you pay your premiums quarterly, Semi-annual, or annually you’ll get a 31-day grace period.

[k, 22.1.1.3) p. 353]

NOTHING is EVER defined in Business Days.

Accidental Means Provision

= You MEANT to engage in the activity so, if injured… No benefit is payable.

- Accidental Means

ONLY pays when the injury is completely unexpected & accidental.

[Example]

If you choose to jump off a diving board and get injured in the process… The policy WOULD NOT PAY. These policies only pay when the injury is completely random.

Florida doesn’t allow Accidental Means policies.

Accidental Bodily Injury Provision

(OR) Accidental RESULTS

= Automatically Assumes ALL injuries are unintentional accidents.

People usually don’t want to get injured.

Accidental Results

ü Jump off the diving board if you want. Be silly and accidentally get injured on film in the process. It doesn’t matter. In Florida, we have Accidental Results policies and those PAY.

MEAN policies would NOT pay

[Compare]

Short-Term Disabilities

(VS) Long–Term coverage options.

Ü Common practice for long-term disability income benefits to have two (2) distinct periods.

à Short = Less than 24-Months

*Own Occupation

Ü After 24-Months à *Any Occupation – Income benefits are reduced. The reduction of income incentivizes the policyowner to return to work, if even only on a part-time basis.

Ü During the “Any Occupation” timeframe, policyowners receive partial disability benefits.

à Amount of income remains a percentage of the income lost.

Ü Why customary waiting periods of 30 to 90-Days are imposed by the employer before deeming an employee eligible for coverage – (Not Benefit).

BUSINESS uses for Disability Income

Business Continuation Plans

[k, (25.3.2.1) p. 395]

- Business OVERHEADExpense Policy

= Reimburses / covers a business for overhead expenses incurred if the owner becomes disabled.

- Expenses defined as,

- Rent / Mortgage

- Utilities

- Telephone Bills

- Leased Equipment

- Employees’ Salaries

NO COMPENSATION FOR THE OWNER!

Premiums are Tax-Deductible & Benefits are TAXED

[k, (25.3.2.2) p. 395]

- Disability Buy–SellAgreement

(OR) Disability Buy–Outs

= Policy benefit is used to PURCHASE (Buy) a disabled partners ownership in the business.

- Legally binding business arrangement.

- Policy benefits are used to purchase the disabled partners share in the business.

- Disability Income Buy-Outs payments are typically paid monthly.

- Lump-Sum Payout provision is available.

- WHYdo Buy/Sell agreements use longer than average Elimination Periods?

- 24–Months is common for a Buy / Sell Elimination Period.

- OASDIElimination Period is 5–months.

- 24–Months is common for a Buy / Sell Elimination Period.

The longer Buy / Sell Elimination Period is designed to ensure the disabled partner won’t be able to return to work within a reasonable timeframe.

[k, (24.2.3) p. 383]

- Group Disability Income plans

= Approximately 90% of the population has insurance coverage offered by an employer.

- COMPARE:Individual policies utilize a Flat / Stated Income Amount.

(VS) Group Disability Income Policies which calculate benefits as a Percentage of Earnings.

- Group Disability Income Policies provide both Short-Term & Long-Term plans

- Short–TermDisability = 13 to 26 Weeks.

- Benefits are typically 50% to 100% of the employee’s income.

- Long–Term Disability

= More than Two (2) Years

- Benefits are typically 60% of the employee’s income.

Disability Income

NAIFA CODES

1. Individual Disability Income Policy NAIFA [k,(18.1) ]

2. Business Overhead Expense Policy NAIFA [k,(25.3.2.1) ]

3. Business Disability Income Policy

4. Group Disability Income Policy

5. Key Employee Policy

B. Accidental Death & Dismemberment :

Accidental Death & Dismemberment

* What are Limited & SPECIAL Risk policies?

Limited Risk and SPECIAL Risk Policies are two (2) other types of Accidental Death & Dismemberment insurances. Standard Disability Income policies ONLY covers basic life events. Limited & Special Risk policies cover the “UNUSUAL Risks” average insurers won’t typically cover.

Think of the AVIATION industry.

à Flying = an Unusual Risk.

é What type of UNUSAL Risk does a Limited Risk Policy Cover?

– Aviation Policies are Limited Risk policies designed to cover the passengers of a specific flight. Benefits would ONLY be payable IF the insured lost body-parts or was killed in an airplane crash.

ü [Note] Use of the word “IF” à Insurance contracts are CONDITIONAL. If no identified incident occurs… NO Benefits are Due.

é SPECIAL Risk cover more EXTREME Situations.

– Think about Tom Cruz test piloting the Experimental Dark Star aircraft in the Movie Maverick.

TEST Pilots are covered by SPECIAL RISK policies. These policies only cover the insured pilot while they’re flying that specifically identified experimental plane. No coverage if they were to have an accident in a different – NOT Identified aircraft.

– Think about an NFL Quarterback like Tom Brady… They’d turn to a Special Risk policy to insure / cover their throwing arm against injury. If they injured their arm and were no longer able to play, they’d be TOTALLY DISABLED.

COMPARE & CONTRAST

Disability Income (VS) Accidental Death & Dismemberment

Pre-Licensing discussions on Disability Income Insurance rely on the insured being declared TOTALLY Disabled before benefits are payable. Partial Disabilities don’t exist UNLESS, you’re TOTALLY Disabled first.

With Disability Income Insurance… Partial disability benefits ONLY come into play after the insureds been disabled for at least 24-Months à 2-YEARS!

[Identify] 24–Months = The Short-Term to Long Term Disability transition.

The insureds benefits are designed to decrease during this short to long term transition. In the first 24-Months of a Total disability, an OWN Occupation benefit structure is used.

AFTER 24–Months of a Total Disability… policies will typically transition into the ANY Occupation definition. Here is where Disability Income finally acknowledges Partial Disabilities. Pre-Licensing only requires us to [Define] a Partial Disability and [Identify] HOW Partial Disability Income benefits are PAID.

é Partial Disability

= “Inability to perform One OR MORE important duties of the job.”

– FLAT Amount Benefit

= 50% of Full Disability Benefits.

– RESIDUAL Amount Benefit

à Based on the percentage of income the insured lost.

Unlike Disability Income policies, ACCIDENTAL DEATH & DISMEMBERMENT (AD&D) Insurance policies acknowledge both Total & Partial Disabilities from the start.

é AD&D Policy Benefits.

– Principal Sum = DEATH Benefit à IF… the insured DIES (OR), experiences a presumptive disability, 100% of the AD&D policy benefit is payable.

– CAPITAL Sum = PERCENTAGE of the Principal Sum à *Partial Disability benefit b/c injuries aren’t as severe as death à Capital Sums vary… The more severe your injuries are, the more you’ll get paid.

ü [Example] The loss of a hand might only pay 50% of the Principal Sum. Losing an entire leg or arm might payout 66% of the Principal Sum.

Capital Sum represents the percentage paid for all qualifying injuries which don’t result in death or a Presumptive Disability.

[CONTRAST] With a Disability Income Insurance, we use the 4-Presumptive disabilities as a benchmark for benefits. On the flip side… AD&D identifies how injuries which are not deemed “Total Disabilities” are addressed.

[k, (19) p. 321]

Accidental Death & Dismemberment

= Third (3rd) most popular type of Major Health Insurance policy sold in the marketplace.

Accidental Death & Dismemberment

Pure Accident Coverage

· AD&D policies pay a specified benefit

· AD&D may be used as a stand-alone strategy

(OR) implemented as a RIDER to enhance a Life or Health insurance policy.

[k, (19.1) p. 322]

é How do Accidental DEATH & DISMEMBERMENT insurers define losses?

= DEATH is the most severe outcome so, 100% of the AD&D benefit is payable.

ü Accidental DEATH

= The loss of Two Limbs (OR) the complete loss of sight is AUTOMATICALLY Presumed to be a total disability

® Principal Sum

= Maximum / 100% of the policy benefit.

ü DISMEMBERMENT

= The complete LOSS of a Limb, Sight, or Hearing.

® Capital Sum

= A portion of the Principal Sum

* Loss of a hand or foot typically pays approximately, 50% of the Principal Sum.

* Loss of an arm or leg typically pays approximately 2/3rds of the Principal Sum

Insurer defines qualifying conditions UNLESS…

The impairment qualifies as a Presumptive Disability.

[NOTE] Principal Sum Payable

PRESUMPTIVE Disabilities.

* The complete loss of Sight, Hearing, Speech, or the loss of at least TWO limbs automatically deem the insured Totally Disabled.

– Typically, the loss of a body part insinuates it’s been completely severed / separated.

– Some policies deem the complete loss of use as a qualifying injury.

DOUBLE INDEMNITY

(OR) TRIPPLE INDEMNITY

· Pays the insured DOUBLE (OR) or TRIPPLE the stated policy face amount if, death occurs under specifically defined circumstances.

[NOTE]

· Despite potentially large payouts, AD&D type policies are considered Valued Contracts. The use of the term indemnity, DOES NOT insinuate the benefits are intended to indemnify.

Indemnity | To Make Whole

Accidental Death & Dismemberment

NAIFA CODE: [k,(19) ]

The Keywords and concepts highlighted in our flashcards also appear in the green boxes throughout the course. THESE ARE the tested topics.

« | Continuing Education & Compliance Period

® One CE Compliance Period is Two Years

® Newly Licensed Insurance Agents MUST complete #24–hours of Continuing Education every two (2) years.

® Newly Licensed = Less than 6–Years

By: Jason L. Perez

Department Authorized Insurance Education Provider

⭐️⭐️⭐️⭐️⭐️ | The Insurance School .com